Portland Metro Real Estate Market Update – November 2025

Seasonal Cooling Meets Uneven Market Shifts Across Price Ranges and Neighborhoods

As we move deeper into the late-fall and early-winter real estate season, the Portland metro area is showing familiar signs of seasonal slowing. Though the degree of market shift continues to vary widely depending on location and price point.

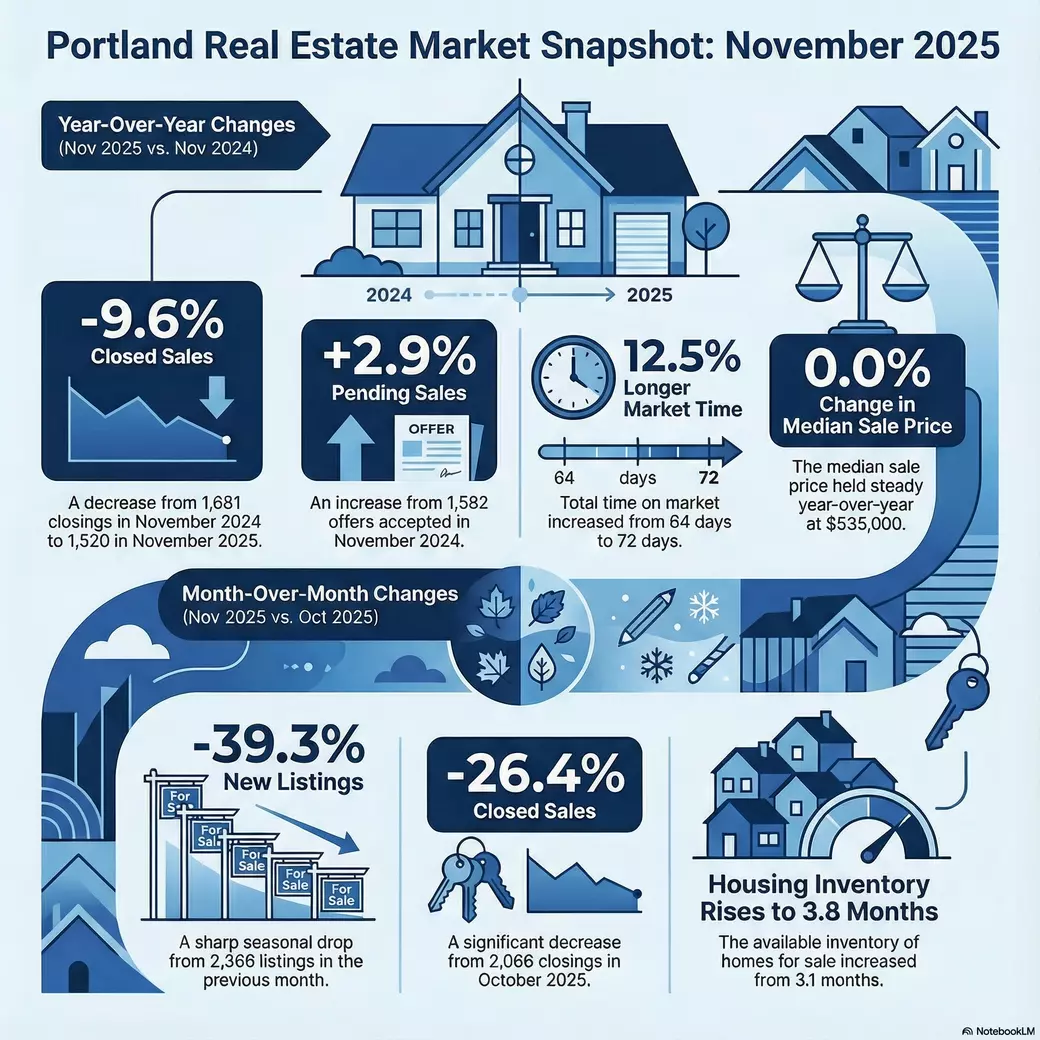

Based on November 2025 data, sales market shifts, defined by sharp percentage fluctuations in sales activity compared to the previous year, varied significantly across different geographic sub-areas and price brackets. While the overall market saw a 9.6% decrease in closed sales and a 26.4% decrease from the previous month, specific pockets of the market experienced deviations far above or below the average.

Geographic Sub-Area Market Shifts

The most notable market shift appeared in the Pending Sales category (accepted offers), highlighting a metro area that, while cooling overall, still shows strong buyer activity in key locations. Some neighborhoods experienced surges approaching 30%, while others saw nearly equivalent pullbacks, underscoring a patchwork market typical of late-year transitions.

Areas Showing the Strongest Positive Movement (Rising Demand)

-

Oregon City / Canby: Led the region with a 30.6% increase in pending sales compared to November 2024.

-

West Portland: Pending sales rose 29.7%, signaling continued buyer interest in this core area.

-

Mt. Hood: Activity remained strong with a 23.1% increase in pending sales. This sub-area also leads the metro in Year-To-Date closed sales growth, up 16.5% for 2025.

-

Gresham / Troutdale: Posted an 18.0% increase in pending sales.

Areas Showing the Sharpest Declines

-

North Portland: Pending sales down 26.3% from last year.

-

Milwaukie / Clackamas: Recorded a 19.2% decline in pending sales.

-

Yamhill County: Experienced a 12.8% decrease.

-

Columbia County: Showed an 11.4% decrease in pending sales.

Market Shifts by Price Range

Market shifts across price brackets also reflect the seasonal slowdown, particularly in the ultra-luxury segment where lower transaction volume often creates more dramatic percentage changes.

Ultra-Luxury ($1.8M+)

-

Homes between $1.8M and $1.9M fell from 8 sales in November 2024 to just 2 in November 2025.

-

The $1.9M–$2M bracket declined from 3 sales to only 1.

Mid-Market ($400K–$500K)

-

Closed sales dropped from 412 in November 2024 to 332 in November 2025.

A Notable Bright Spot ($1.4M–$1.5M)

-

Closed sales rose from 6 in 2024 to 10 in 2025 — an uncommon upswing for this time of year.

What the Market Is Telling Us

Overall, the Portland metro saw a 9.6% drop in closed sales, but this headline number doesn’t capture the full story. Instead, the market resembles a series of micro-environments reacting differently to shifting inventory, buyer motivation, and seasonal patterns.

Real estate has and always will be hyper-local, as these statistics show. While the majority average is trending downward, many sub-areas sit at dramatically different heights. North Portland is experiencing a stronger-than-usual seasonal cooldown, while Oregon City and West Portland remain elevated with substantial increases in pending activity. Despite this, the market remains resilient with prices holding steady and staying mostly flat.

Connecting with a local agent is vital when planning your next move to stay ahead of the curve in the current market conditions. Contact me for a strategy session today.